I just put my life savings into the startup I work for

During the past six months I’ve transferred our life savings out of a high interest savings account, and into an investment account managed by Clover, the startup I work for.

Money! Startups! Investing! Woo hoo!

It might sound crazy, but it’s the most considered financial decision I’ve ever made.

My wife and I started our careers working in lower-paying industries: a not-for-profit (me) and social work (her). We’ve never had a laser focus on earning or saving money. Yet, through a combination of luck, discipline, and work, we’ve been able to save up a good stash.

Normally, two 30-somethings with a toddler would take that money and buy a house. And if we lived anywhere else in the world, we probably would. But given that Melbourne real estate is amongst the most expensive in the world, we simply can’t afford to buy a property that we’d want to live in. For example, in the neighborhood we live in, a 3-bedroom 1-bathroom house costs $1.5 million.

Renting, for us, is a much better option at the moment.

Thus, we had a solid chunk of money sitting in a savings account, and no plans to put it to work. The problem with money in the bank is that with the current interest rate, your money is actually losing value.

In this post I’ll go over our process of choosing to invest, our investments, what we’ve earned so far, what the risks are, and what to consider before investing.

Ok, let’s get started.

Nobody Talks About Money…

More than a quarter of Australians (28%) said they don’t like talking about their finances openly with others, more than any other topic measured including health, relationships, politics, career, death, religion, taxes and emotions — but not sex (36%). source

Despite our generation’s push for transparency and authenticity, it’s fair to say most of us don’t talk very openly about money. Not with friends. Not with family. I certainly don’t know what my friends or family members make, nor have in the bank, nor how they invest. And that’s not necessarily bad — there’s a lot better ways to think about people than their net worth.

But it does mean that when you start building up savings, you might be in the same situation that my wife and I found ourselves in, which was asking the question: So what now?

Yes, not knowing the best way to be financially savvy with savings is absolutely a first world problem, but it was a problem nonetheless.

Our requirements for investing

My wife and I had five main requirements:

We wanted to be reasonably liquid. We don’t have our lives totally planned out, so we wanted the ability to withdraw our money at a few day’s notice.

We wanted the right level of risk. Something with more potential return than a savings account, but not something that could go bust (ahem, bitcoin).

We didn’t want to add extra work or stress. We have busy lives. The last thing I want to do is wake up and check my share portfolio in the middle of the night, or make changes based on political events. We wanted a solution we can set and forget.

Reasonable fees. I understand that there are fees involved in investing, but I don’t want to pay for someone else’s BMW. Thanks for the tip, John Oliver.

We wanted some investment outside of Australia. Because I’m American, and there’s a strong possibility we’ll someday live in a country other than Australia, we’re uncomfortable putting all our money on Australia. It’s a great country, but as it’s only 2% of the global economy, we didn’t want to put all our eggs in this one basket.

Enter: The Financial Advisor

In 2015 we made an appointment with a financial advisor, because it sounded like a responsible thing to do.

Hooray! You’re an adult.

The first advisor we met with was kind, helpful, and clear that we couldn’t afford their services. The firm is for the wealthy, and operated on a fixed-fee cost of $10,000 a year. Not quite what we had in mind.

The second advisor we met with was recommended by a friend. We sent all our documents and details, took a few hours off work, and met in their office. After two hour-long meetings we left with a “Statement of Advice”, a giant document financial advisors give you which contains the recommendations and fees. Their advice was to buy certain shares, move our superannuation to their firm, and change our insurance.

Not knowing too much about finances, we ended up not using their service due to two reasons: fees, and their recommendation to purchase individual shares.

Fees

After a careful look though the fees, the annual costs would have been more than 2% of our total investment, which seemed like a lot. However, the Australian Securities and Investment Commission uses 2% in their example here (including the cost of advice, investment management, and administration platforms) so 2% per year must not be unprecedented.

Investment Approach

Having read a few books about investing, I wasn’t confident in their active “share-picking” approach to investing. As a recent study showed that 99% of actively managed US equity funds underperform, and I’m not enough of an optimist to think I’ll be in the 1%.

Recently I had a look back at the Statement of Advice and was especially thankful I’m not invested in one particular share recommendation. It’s one of the worst performing shares in the S&P500, and has lost 65% of it’s value since it was recommended to me.

Enter: The Robo-Advisor

The robots are coming… and they’re bringing financial advice. Buckle up.

In May 2016, I spoke to my mate Darcy about clover.com.au, an investment advisor startup he was working on. The Clover team was trying to replicate the service that investment advisors provide, but with lower barriers to entry, better investment methodologies, and at a fraction of the cost.

It’s an idea that is popular in the USA — Betterment and Wealthfront manage a combined 10 billion dollars in America — but it hasn’t really caught on in Australia yet. (If you listen to podcasts, you might recognise Betterment or Wealthfront as frequent sponsors.)

Robo-advisors learn about your age, financial details and your risk tolerance, and then recommend and manage an investment plan for you. Because it’s technology-driven and all done online, the fees are way less than a human advisor.

I was immediately interested in Clover both as an employee and customer.

In double good news, I started my role in October, and opened our account the same month.

Our Portfolio

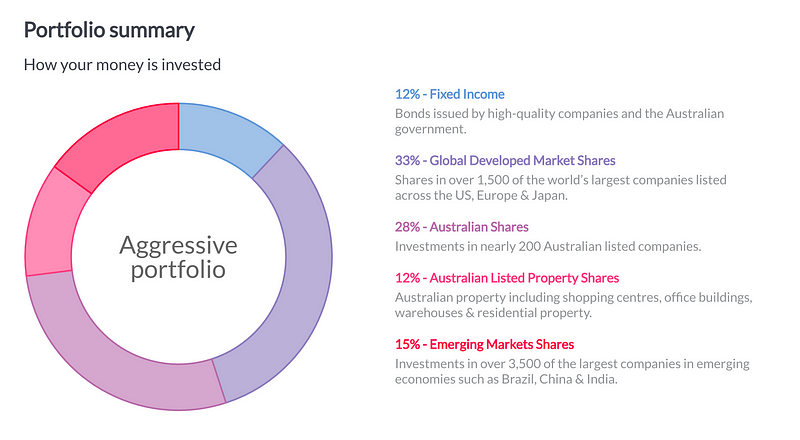

After going through the onboarding process, Clover recommended an Aggressive portfolio with the following investments:

This portfolio is on the higher end of the risk/reward scale, which is what I was looking for. It also met my four other requirements: liquid, no extra work, low fees, and strongly diversified. The funds listed above are spread out over 30+ countries and more than 5,000 individual companies.

Fees

I pay Clover 0.55% per year for portfolio management (which includes brokerage costs), and the ETFs have an inbuilt cost of approximately 0.25% per year. Together, that’s still 2.5 times less expensive than the human advisor.

Investment Approach

Clover, like almost all roboadvisors, embraces Exchange Traded Funds for investments, which allow investors to buy an entire index like the S&P500. This is a far superior approach to buying individual company shares (like the human advisor had suggested) and mean my investments aren’t dependent on a single or small group of companies performing well.

We also committed to a savings goal that we deposit into Clover each month, and is then automatically invested for us.

Our Results (so far)

Since October 2016, we’ve invested six figures into our portfolio. We’re currently up 11.22%. I’ll be honest, it’s a strange feeling checking our account and seeing money grow with no effort or action required (other than accepting the risk, more on that below).

Perhaps even more important than the 7 month return — which is largely based on rising share markets around the world — is our change in behaviour.

Since we’ve started following our recommended investment plan…

We have a clear monthly goal we’re aiming to add to the investment account

We’re no longer worried that we’re missing out on the real estate boom

We have more peace of mind, knowing we’re “doing something adult-like” with our savings.

The Risks

All investing comes with risks. With a portfolio like mine, it’s possible to drop something like 30% in a year if the Global Financial Crisis were to happen again. You can see historical performance here, noting the dip in 2008 that affects higher-risk portfolios more. The key with managing our risk is knowing how long we plan to invest for (Clover recommended 7+ years), and make sure we can hold our investment during a time of temporary loss in value.

That being said, our portfolio is way less risky than something like investing in individual shares, which in theory have the potential to go to zero.

And what if Clover goes out of business?

Yeah, that’s a question I had too. The bad news is I’d be out of a job, but the good news is our investments wouldn’t be affected. Because Clover buys the investments in our name, we own the investment (not Clover), which is comforting.

Summary & Referral Links

So obviously I’m a pretty big fan of robo-advisors and automated investing.

If you’re in Australia and want to try Clover, you can use my referral code to get $5,000 managed for free:

https://app.clover.com.au/onboarding/?referral=QJcJIl

If you’re not in Australia and you want to use a roboadvisor, there’s a bunch of good options around the world. Here’s the the most well known of the bunch:

USA (referral bonus links): Wealthfront, Betterment

Canada: WealthSimple

UK: Nutmeg

Germany: Scaleable Capital

Thanks for reading. I hope that by sharing my thought process and investment decisions, it brings you less stress, not more.

If you have a moment, I’d love to hear your feedback in the comments below.

And if you found this helpful, please hit the ❤ below. Thanks!